How Much Can You Contribute To Hsa 2025

BlogHow Much Can You Contribute To Hsa 2025. These amounts are approximately 7% higher than. Your contribution limit increases by $1,000 if you’re 55 or older.

Those 55 and older can contribute an additional. The health savings account (hsa) contribution limits increased from 2025 to 2025.

Individuals can contribute up to $4,150 to their hsa accounts for 2025, and families can contribute up to $8,300.

Significant HSA Contribution Limit Increase for 2025, The limits on annual contributions for 2025 are $4,150 for individual coverage and $8,300 for family coverage. For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150.

How Much Can You Contribute To Hsa In 2025 Katya Melamie, An hsa is a savings account for health expenses that offers tax advantages. Savers age 55 and over can.

What Is The Max Hsa Contribution For 2025 2025 JWG, Leslie harding · december 10, 2025 · 5 min read. For 2025, you can contribute up to $4,150 if you have.

How much should I put into my HSA? Lively, It is important to understand the rules. Plus, the money in your hsa that you don't need to withdraw.

2025 HSA & HDHP Limits, The maximum contribution for family coverage is $8,300. If your employer contributes $500 annually,.

HSA Contribution Limits 2025 Millennial Investor, Hsa contribution limits for 2025 are $3,850 for singles and $7,750 for families. The limits on annual contributions for 2025 are $4,150 for individual coverage and $8,300 for family coverage.

2025 HSA contribution limits increase considerably due to inflation, The limits on annual contributions for 2025 are $4,150 for individual coverage and $8,300 for family coverage. Calculate your estimated tax savings for next year using contribution information.

How much should I contribute to my HSA? WEX Inc., What is a health savings account? The limits on annual contributions for 2025 are $4,150 for individual coverage and $8,300 for family coverage.

What are the 2025 HSA contribution limits? WEX Inc., The limits on annual contributions for 2025 are $4,150 for individual coverage and $8,300 for family coverage. These amounts are approximately 7% higher than.

.png)

IRS Announces Updated HSA Limits for 2025 First Dollar, The hsa contribution limit for family coverage is $8,300. Hsa contribution limits for 2025 are $4,150 for singles and $8,300 for families.

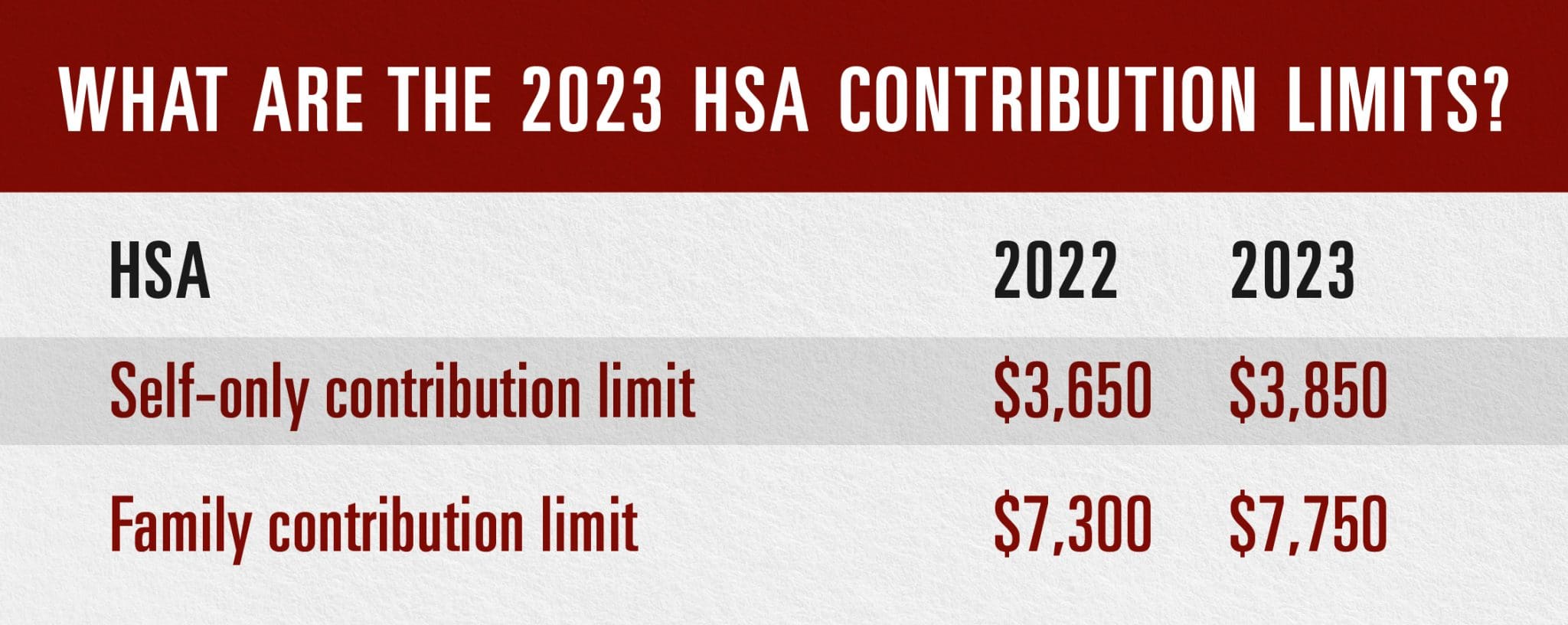

The health savings account contribution limits for 2025 are $3,850 for individuals and $7,750 for families.